Call option profit formula

Since the stock price is below the strike price the option ended worthless for the call option buyers and SIRI was able to pocket the 3 premium per lot by selling the call options. The contract offers the buyer the right but not.

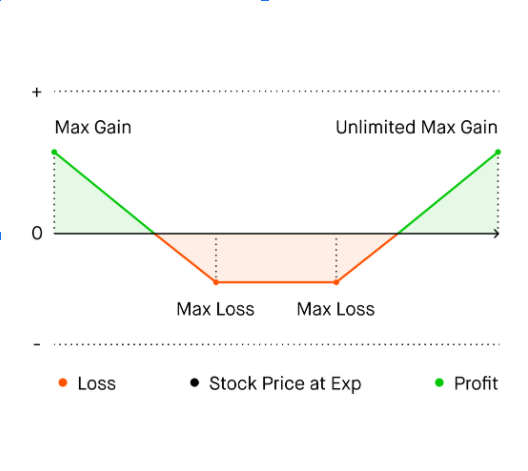

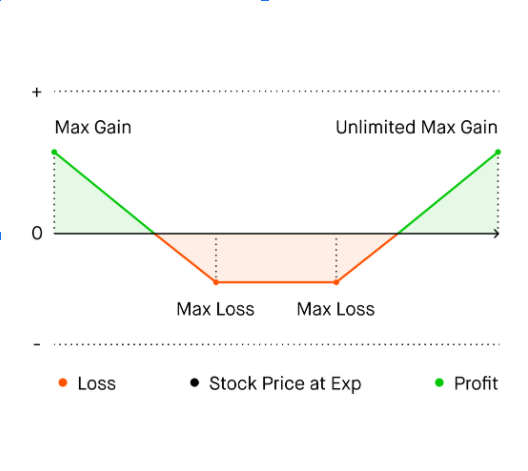

The P L Chart Robinhood

The stock costs 19 and the OTM 20 Call is sold for 125.

. The simple maximum profit calculation of a poor mans covered call is the same formula as a bull call spreads max profit. Being OTM the calls premium is all time value. Cash flow at expiration.

But the appreciation in the price of the stock far out-paced this loss. The breakdown point is the point at which the call option seller gives up all the premium he has made which means he is neither making money nor is losing money. This allows us to create a synthetic call or put option.

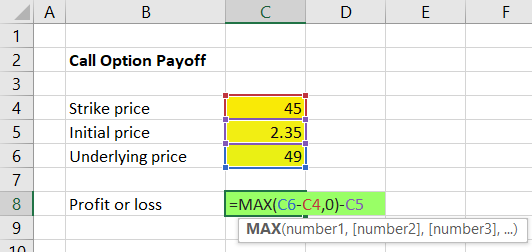

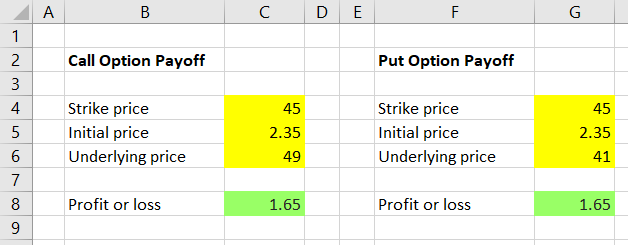

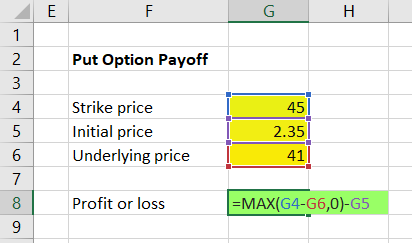

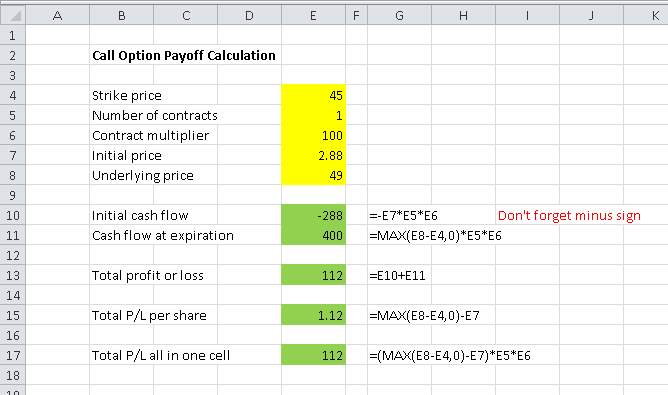

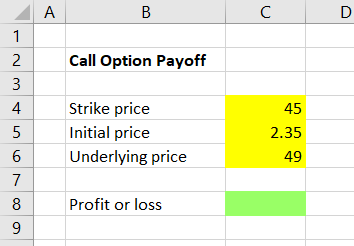

If the derivative would have positive intrinsic value if it were to expire today it is said to be in the money. It is true that the investor lost money on the call option. This is the first part of the Option Payoff Excel TutorialIn this part we will learn how to calculate single option call or put profit or loss for a given underlying priceThis is the basic building block that will allow us to calculate profit or loss for positions composed of multiple options draw payoff diagrams in Excel and calculate risk-reward ratios and break-even points.

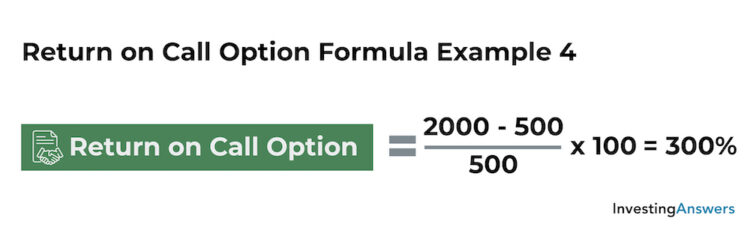

3 Divide sum additional profit on exercise time value by net trade debit. Call Option Example 3. The options price when you bought it.

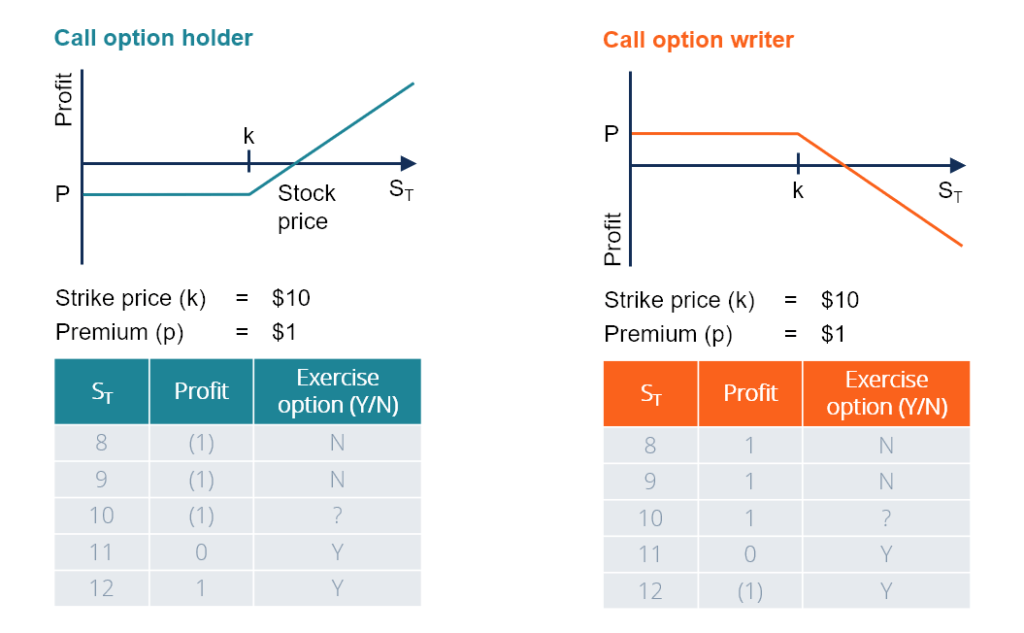

Since the option will not be exercised unless it is in-the-money the payoff for a call option is. At the end of the March month the stock ended at 168. For example a call option with a strike price of 105 may have an expiration date of March 30 while another.

Time to expiry The longer the time to expiry the pricier the call or warrant. But buying 100 shares of stock requires significant investment. Recall the formula for calculating profit or loss when a put you sell is exercised.

--- Reconnectcheck connect Reconectar e checar se está conectado Caso ocorra algum erro e a conexão com a IQ seja perdida você pode estar implementando isto python from iqoptionapistable_api import IQ_Option import time loggingbasicConfiglevelloggingDEBUGformatasctimes messages. An option is a financial derivative that represents a contract sold by one party the option writer to another party the option holder. Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same.

Number of option contracts you have bought. If a portfolio of the synthetic option costs less than the actual option based on put-call parity a trader could employ an arbitrage strategy to profit. A call option has positive monetary value at expiration when the underlying has a spot price S above the strike price K.

If the stock is called out at the 20 strike price the writer keeps the original 125 in premium and gets an additional 100 of profit. The net profit from this covered call is Net profit. A put option is out-of-the-money if the strike price is below the market price of the underlying stock.

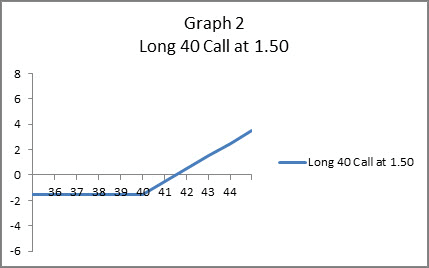

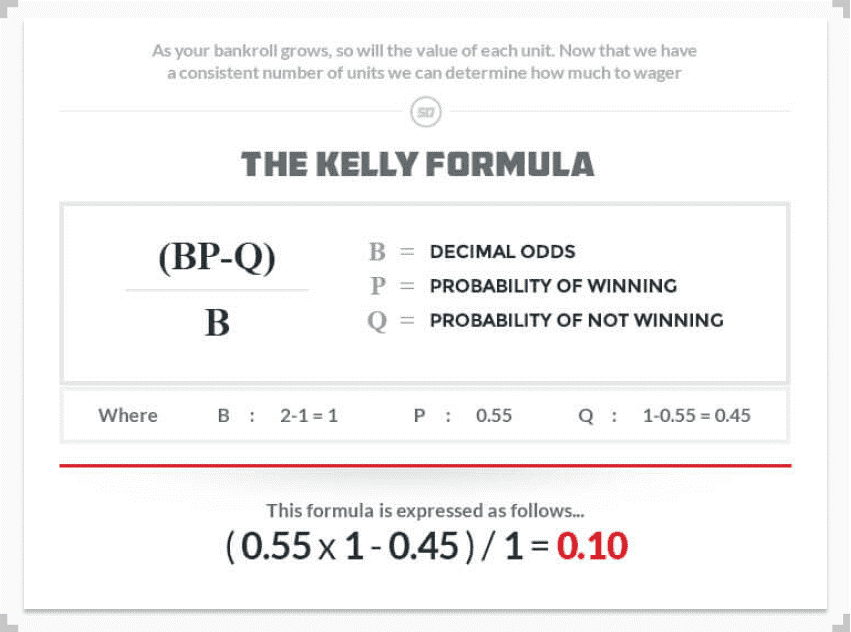

PL formula for the Call Option Buyer. Rearranging this formula we can solve for any of the components of the equation. If the stock price falls below 40 and the option holder exercises the option youll lose 1 for each penny the stock drops below 40.

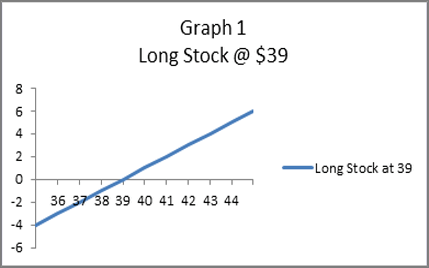

In finance moneyness is the relative position of the current price or future price of an underlying asset eg a stock with respect to the strike price of a derivative most commonly a call option or a put optionMoneyness is firstly a three-fold classification. Initial cash flow is constant the same under all scenarios. The total profit or loss from a long call trade is always a sum of two things.

The profit of an option seller is restricted to the premium he receives however his loss is potentially unlimited. If the stock trades between 45 and 50 the option will retain some value but does not show a net profit. Because there are two expiration dates for the options in a diagonal spread a pricing model must be used to guesstimate what the value of the back-month call will be when the front-month call expires.

Call Option Payoff Formula. This is one of the reasons behind the selling of call options. What is the Put-Call Parity Equation.

Conversely if the stock remains above the strike price of 50 the option is out of the. It is possible to approximate break-even points but there are too many variables to give an exact formula. Remember each option covers 100 shares of XYZ so a difference of one penny in the stock price means losing 100 pennies or 1.

If it would be. Shortswrites an out-of-the-money OTM call option against the shares. It is a product of three things.

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Call Option Example Meaning Investinganswers

Calculating Call And Put Option Payoff In Excel Macroption

Merging Call And Put Payoff Calculations Macroption

Free Download Position Size Calculator Fo Rex Stocks And Commodity Trading Using Microsoft Excel Forex Trading Commodity Trading Trading Courses

Option Basics Explained Calls And Puts Economics Lessons Trading Charts Option Strategies

Calculating Call And Put Option Payoff In Excel Macroption

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

Amibroker Knowledge Base Quickafl Facts Stock Data Facts Exponential

Call Option Profit Loss Diagrams Fidelity

Call Option Profit Loss Diagrams Fidelity

Hedging Vs Speculation All You Need To Know In 2022 Accounting And Finance Investing Risk Management

Studywalk Methods Of Forecasting Naive Moving Average Exponential Smoothing Weighted Moving Average Tre Charts And Graphs Moving Average Trend Analysis

Probability Of Profit Pop Is It Important Yes

Call Option Payoff Diagram Formula And Logic Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Understand How Buying Selling Call Options Works